What is Frontrunning?

MEV, or maximal extractable value, is a hidden tax on Ethereum transactions that has been responsible for over a billion dollars in value loss for traders to date.

Frontrunning is a particular type of MEV that affects all forms of Ethereum transactions including trades, NFT mints, and more. This article is part of a series on MEV where we also cover the other two common types of MEV: sandwich attacks and backrunning.

What is frontrunning and how does it work?

Frontrunning occurs when a user makes a transaction but gets "frontrun" by an MEV bot who makes the same transactions ahead of them.

The Frontrunning Process

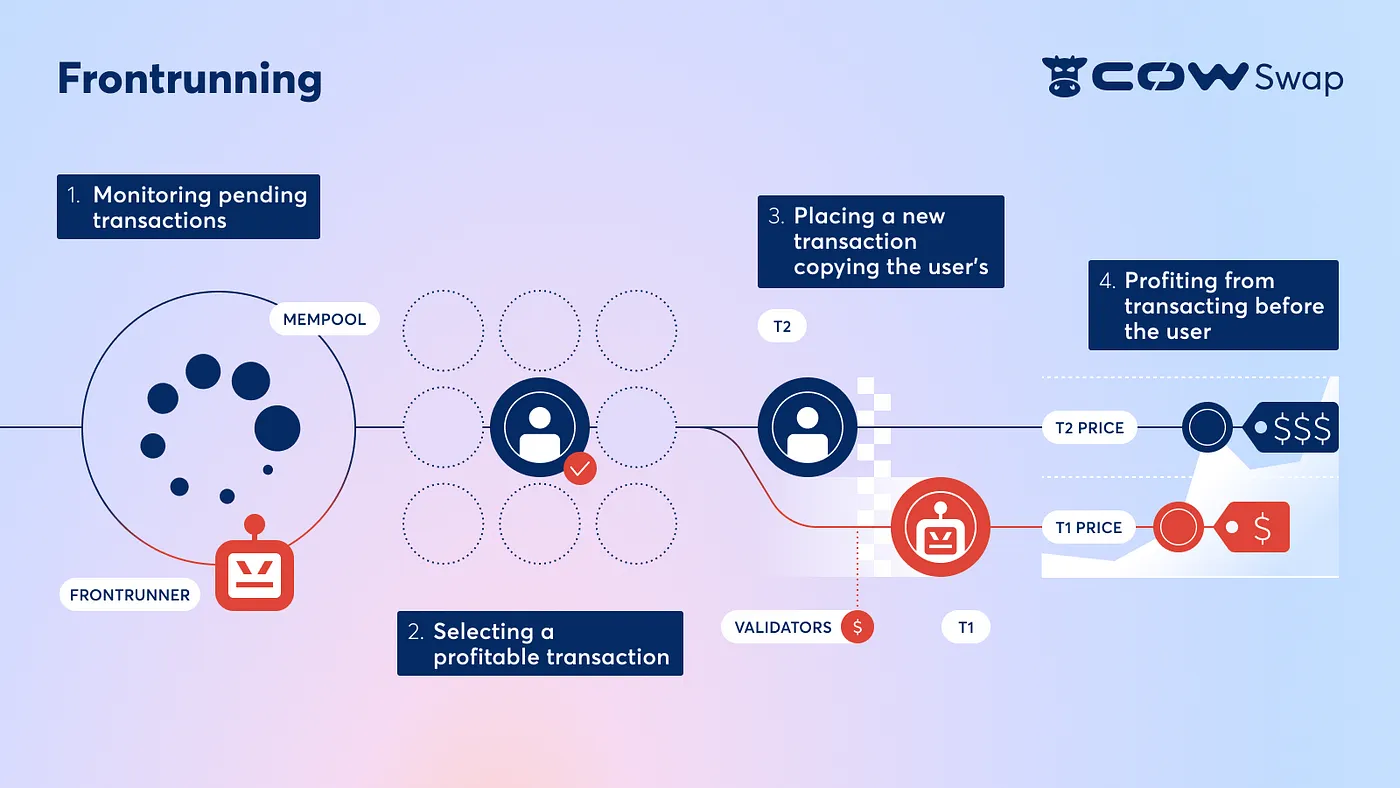

Frontrunning takes advantage of the open nature of the blockchain mempool, as anyone can view transactions. MEV bots exploit this transparency to hijack trades. Here's a basic rundown of the process:

-

Monitoring Pending Transactions: The first step involves monitoring the blockchain network's mempool, a holding area for pending transactions. Here, frontrunners, who are often sophisticated bots, scan the mempool to identify transactions that can carry significant value that they want to snatch away or that could influence the price of a particular asset.

-

Selecting Profitable Transactions: The frontrunner will analyze the potential market impact once such a transaction is identified. For instance, if a large buy order for a specific token is detected, the frontrunner knows that this transaction could increase the asset's price once processed.

-

Placing a New Transaction: The frontrunner will initiate their buy order for the same asset, intending to get their transaction processed before the initially detected transaction. They typically give the validators a higher "tip" to execute their transaction first in the block in comparison to the target transaction.

Example: Frontrunning in DeFi

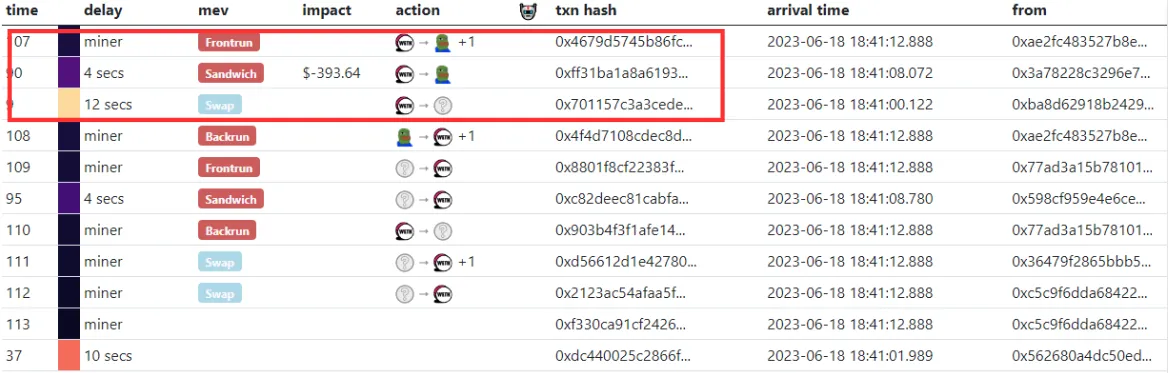

A notable example of DeFi frontrunning involves the notorious MEV bot named "jaredfromsubway.eth." In one case, a user, 0x3a7822, intended to trade 2 ETH for another token, $BOB.

How the frontrunning attack was executed

This trade was noticed by the bot jaredfromsubway.eth, which monitored the mempool for transactions it could take advantage of.

Once the transaction entered the mempool, jaredfromsubway.eth quickly executed its own transaction to buy $BOB with ETH, strategically placing it as the first transaction in the block, and knowing that he would get the assets at a discount as the transactions behind will increase the price of $BOB. MEV allows validators to prioritize transactions that are of the most value to them. Consequently, the bot's transaction, being the first one in the block, was confirmed ahead of the user's transaction.

The consequences of the frontrunning attack

The frontrunning attack triggered an increase in the price of $BOB tokens due to the additional demand created before the user's transaction was processed. When the user's original order of 145M $BOB was executed, it was conducted at this now-inflated price, leading to user 0x3a7822 receiving significantly fewer $BOB tokens, hence losing out on the value they could have otherwise captured.

Jaredfromsubway.eth completed its MEV attack by selling its $BOB tokens at an increased price, resulting in a profit, a second move that turned this MEV attack into a sandwich attack. In this scenario, the price impact triggered by the frontrunning bot meant that user 0x3a7822 encountered a worse trade-off, ultimately making a loss while the MEV bot profited — an estimated gain of 0.1 ETH.

How Harmful is Frontrunning?

While frontrunning may seem harmless or even clever to some, it can adversely affect individual traders and compromise the overall integrity of the Ethereum network.

Impact on traders

Frontrunning disrupts the fair operation of financial markets. By exploiting pending transactions, frontrunners manipulate market conditions to their benefit. This can lead to distorted prices, impacting regular traders who abide by market rules. What's more, these traders miss out on the value they would have otherwise derived from their trades. But most importantly, frontrunning attacks keep users from receiving the full value of their trades.

Long-term market consequences

Over time, persistent frontrunning can erode market confidence. As traders realize they are consistently at a disadvantage due to frontrunning, they may lose faith in the integrity of the market and choose to leave. This could result in diminished market participation and liquidity, both of which are critical for overall market health and efficiency.

Network effects

Frontrunning can also have wider implications for the underlying network. It can cause network congestion, since unnecessary transactions in a block slow down transaction processing times.